Table of Content

In working life, everyone looks forward to pay raises – as a well-deserved reward after hard work and as a hope for greater financial comfort. But in reality, many discover that even though their salary has increased, their month-end balance looks almost the same. Why does this paradox happen? And how can each raise truly bring you closer to financial freedom?

When a Raise Doesn’t Mean Getting Richer

Many people believe that once they get a raise, their financial life will automatically improve: more comfortable spending, bigger savings, and a fuller bank account. The truth, however, is different: plenty of people have experienced the feeling of “higher salary, but an empty wallet,” sometimes even ending the month in debt.

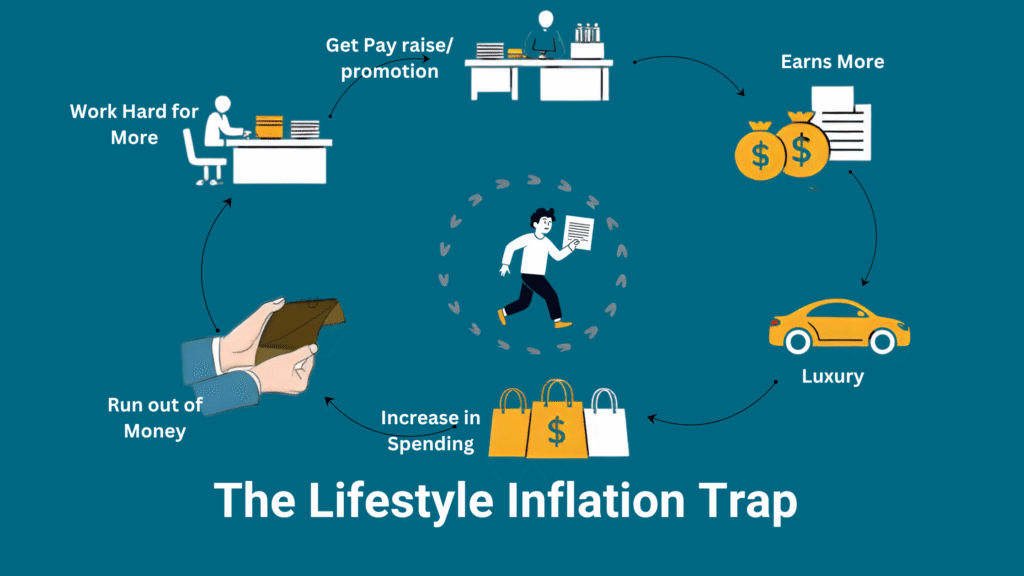

So why does this paradox occur? The reason doesn’t lie in the size of the paycheck, but in how we manage financial changes when income rises. Without control, a raise simply becomes an “excuse” to spend more, creating a vicious cycle: income increases – needs expand – balance stays the same.

The “Lifestyle Inflation” Effect – A Sweet Disease That Kills Your Account

When salaries increase, people often fall into “lifestyle inflation” – spending more and more to upgrade their lifestyle. A new smartphone, a few fancy dinners, the daily coffee habit… all of these gradually pile up into recurring expenses.

At first, rewarding yourself after a raise may seem reasonable. But without limits, these “rewards” quickly turn into “defaults.” The result: the extra income no longer exists in your account but instead flows into a costlier lifestyle.

A Raise but Debt Still Grows – Why?

What’s more concerning is that many, after receiving a raise, feel confident enough to take on more consumer debt: buying a car on installments, renovating their home, opening new credit cards. The thought “I got a raise, I can afford this” inadvertently creates heavier debt pressure, while high interest rates leave the month-end balance in the red.

In fact, quite a few people even view their raise as an excuse to spend first and wait for the next paycheck to cover it. This habit is essentially “buy now, pay later” – meaning their account balance doesn’t increase, but actually shrinks.

The Vicious Cycle of Social Comparison and the “Hedonic Treadmill”

One often overlooked factor that strongly influences how we use a raise is social comparison. Human beings naturally evaluate their standard of living based on what others have. When friends buy a new car, colleagues travel to Europe, or neighbors renovate their homes, these invisible comparisons create pressure to “keep up.” As a result, the extra income from a raise is quickly funneled into spending meant to maintain social status, rather than being saved or invested.

From the perspective of behavioral psychology, this is also explained by the hedonic treadmill effect. As income increases, people automatically raise their expectations and redefine what happiness looks like. A new smartphone may bring joy for a few weeks, but soon it becomes “normal,” fueling the desire for the next upgrade. This cycle repeats itself endlessly, meaning that no matter how many times your salary rises, your level of satisfaction resets to the starting point, while your account balance fails to grow.

The combination of social comparison and the hedonic treadmill creates a psychological trap that is difficult to escape. You may think you are spending money to be happier, but in reality, you are chasing a finish line that never arrives. The ultimate outcome is that a raise improves the appearance of your lifestyle, but not your financial health.

Inflation and Hidden Costs

Another major reason a raise does not always fatten your bank account is inflation and hidden expenses.

Inflation quietly erodes the purchasing power of money. When the price of goods and services rises by an average of 3–5% per year, a 10% salary increase effectively provides only about 5–7% more disposable income after adjustment. Without factoring this in, it is easy to fall into the illusion of being wealthier, when in fact, much of the raise has already been consumed by the market.

At the same time, hidden costs are another culprit behind the disappearance of a raise. These are expenses that don’t appear explicitly in a personal budget but rise in tandem with income: higher personal income tax, larger social insurance contributions, increased office or community funds, and subtle social spending like dinners, weddings, or group activities. Behavioral finance research shows that when someone earns more, those around them often expect their “social contributions” to increase accordingly—creating additional spending pressure.

The result is that, while a raise improves the number on your paycheck, your actual month-end balance often shows little change. In some cases, if spending isn’t well controlled, the balance may even decrease because expenses rise faster than income.

To break free from this cycle, the solution isn’t simply saving more or cutting back arbitrarily. It lies in understanding the true nature of inflation, anticipating hidden costs, and building a financial plan that adapts to them. With a professional perspective, it becomes clear: a raise is only a necessary condition; discipline and strategy are the sufficient conditions for your balance to truly grow.

How to Make a Raise Truly Build Wealth for You

1. Separate the Extra Amount

When you receive a raise, the very first thing to do is clearly identify the difference compared to your old salary. Don’t let this amount blend into your regular monthly spending, because you’ll easily forget it ever existed. The best approach is to set up an automatic transfer into a savings or investment account as soon as your salary arrives.

For example, if your salary increases from 15 million to 20 million, immediately “lock” 5 million into a separate account. This way, you not only maintain discipline but also build the habit of treating the raise as capital for accumulation rather than for extra consumption.

2. Maintain Your Old Lifestyle for Six Months

A common mistake is to upgrade your lifestyle right after a raise: buying a new phone, moving into a bigger place, or dining out more often. Instead, restrain yourself for at least the first six months. During this time, keeping your lifestyle unchanged will show you the real impact of the raise on your account balance. It also serves as a “testing phase” for your money management skills after a salary increase.

After half a year, if you want to upgrade your lifestyle, allocate no more than 30–40% of the extra income to spending, and continue directing the rest toward saving and investing.

3. Reallocate to Small Investments – Real Returns

A raise is the perfect opportunity to experiment with investing, even if the extra amount isn’t very large. You can choose online savings deposits for safe interest, or purchase mutual fund certificates with just a small starting amount.

If you want to explore higher-potential opportunities, prop trading is worth considering: with only a small outlay, you can access significantly larger trading capital. This is how you “replicate” your raise, turning it from a static figure into an asset that generates steady returns.

4. Avoid the “I Deserve It Right Now” Mentality

Getting a raise often sparks the thought: “I deserve this—I’ve worked hard, so I can treat myself.” Behavioral finance research shows that people tend to value new income more than maintaining discipline with it. In other words, when salaries increase, most people prefer instant gratification over saving or investing.

The problem is that if this mindset repeats, your extra income will quickly turn into impulsive purchases. Apply the 30-day rule: whenever you want to buy something expensive, write it down, wait 30 days, and then reconsider if it’s truly necessary.

In reality, more than half of impulsive desires fade after a few weeks. This practice protects your balance from being eroded by emotional decisions.

5. Invest in Skills – Build Long-Term Value

The smartest way to maximize a raise is to use it as leverage for your career and personal growth. Dedicate part of it to learning new skills: languages, professional certifications, or areas such as data analysis, trading, or personal financial management. This is not money wasted, but an investment in your most important asset: yourself.

As your skills grow, your future income won’t stop at just one raise—it can open the door to more career opportunities and additional income streams.

Key Lesson

A raise is only a necessary condition, not a sufficient one, for building wealth. Without smart management, a raise brings only short-term satisfaction rather than long-term prosperity.

Always remember: A raise doesn’t make you rich—discipline does.

Conclusion

If you’ve ever experienced the reality of “a raise without a higher balance,” pause and reflect on how you’re using that difference. Turn every raise into a stepping stone toward financial freedom, rather than an excuse to spend more.

With discipline and the right investments, extra income will no longer be an illusion but the solid foundation for true wealth accumulation.