1. Small Daily Expenses Add Up Fast

Spending just a few dollars here and there doesn’t seem like a big deal—until it is. A $2 coffee, a $6 lunch, a $4 snack, and a $10 impulse buy on a shopping app. Do that five days a week, and suddenly you’re burning $100+ monthly without even realizing it.

That’s over $1,200 a year that’s untracked, unplanned, and ultimately lost—purely because of poor personal expense management.

2. You Don’t Track What You Spend

The truth? Most people don’t record their daily expenses. If you ask someone what they spent in the past 72 hours, they’ll likely forget half of it. This habit of untracked spending leads to a false sense of security—until your bank statement arrives.

Without clear records, it’s impossible to know where your money actually goes. Apps like Monefy, PocketGuard, or a simple notebook can be your first step to financial clarity.

3. You Don’t Know Your Cash Flow

Personal finance isn’t just about how much you earn—it’s about how much you keep. Many earn well but still feel broke because they don’t manage their cash flow.

Cash flow means knowing:

- What’s coming in (your income)

- What’s going out (your expenses)

- When those amounts change

Lack of cash flow awareness makes it easy to overspend early in the month and panic by the 20th.

4. Your Spending is Emotion-Driven

If your first reaction to stress, boredom, or celebration is to buy something—you’re emotionally spending. And emotional spending rarely aligns with long-term goals.

A common trap: “I had a bad day, I deserve this.” Multiply that by 10–15 impulsive moments a month and you’ll sabotage your savings without noticing.

Understanding your emotional triggers helps you cut down unnecessary expenses before they happen.

5. You Don’t Have a Simple Budget System

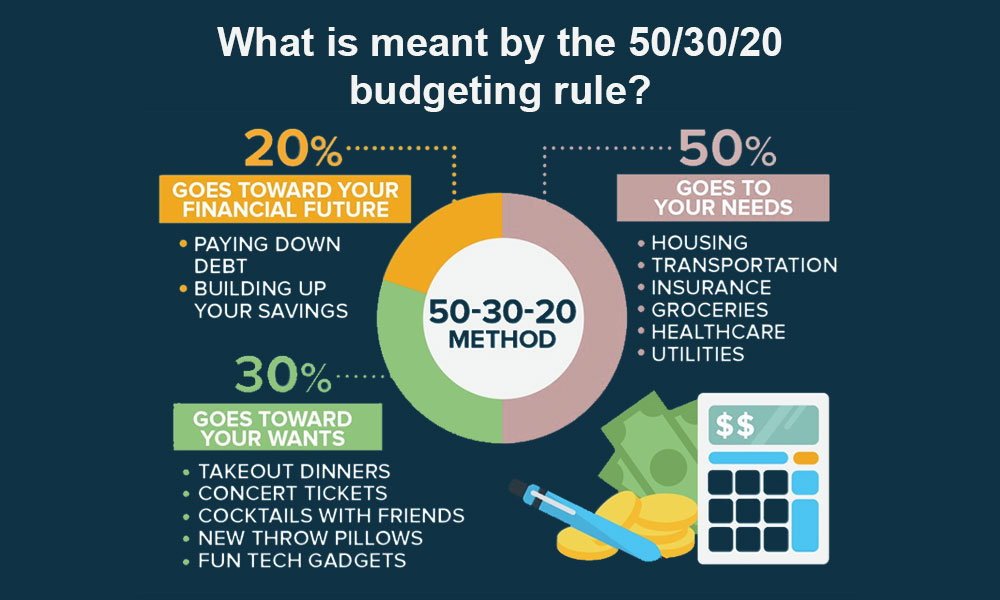

Many people assume budgeting is time-consuming or restrictive. But even a simple “50-30-20” rule can give you structure:

- 50% needs (rent, bills, food)

- 30% wants (shopping, eating out)

- 20% savings or debt repayment

When you assign a job to every dollar, you reduce decision fatigue and increase savings—even on the same income.

6. What Happens When You Don’t Manage Personal Expenses?

- You miss out on saving opportunities

- You live paycheck to paycheck

- You fall into debt for emergencies

- You constantly ask, “Where did all my money go?”

It’s not that you earn too little. You just don’t manage what you already have.

7. Real-Life Math: $3/Day = $15,000 in 20 Years

Let’s say you spend $3 daily on unnecessary items. That’s about $1,095 per year. If you invested that with a 7% annual return, in 20 years you’d have over $15,000.

That’s the power of discipline—and the cost of small, untracked habits.

8. Quick Fixes for Better Expense Control

- Track Everything for 30 Days: You’ll be surprised where your money really goes

- Set Weekly Limits: Use cash envelopes for daily spending to stay within budget

- Use Budgeting Apps: Let tech remind you when you overspend

- Review Weekly: A 10-minute Sunday night review changes everything

- Start a “No-Spend Challenge”: Choose 1–2 days a week to spend absolutely nothing

Final Thoughts

Money doesn’t vanish—it moves quietly through untracked spending and emotional decisions. When you don’t manage it, it manages you.

The solution isn’t more income. It’s better personal expense management. Start small, stay consistent, and you’ll begin to see big changes—not just in your account balance, but in your peace of mind.