When Self-Trading Is No Longer the Only Choice 🚦

“Should I trade on my own or join a prop firm?” — this is a hot topic drawing thousands of daily interactions across professional forums, Facebook groups, and financial YouTube channels. More than just a question of trading skill, it’s a crucial career decision: How can a trader sustainably maximize profits, minimize risks, and build a solid long-term foundation in the ever-volatile financial markets?

Many traders who once used personal capital faced intense hardships — emotional burnout from repeated losses, self-doubt, and even losing faith in their own abilities. In that context, the prop trading model emerged as a promising alternative. It allows traders to access large amounts of capital without investing their own funds, while receiving support from cutting-edge tech ecosystems, including smart AI dashboards and transparent payout policies from top-tier firms like AI Prop.

But is prop trading truly the “holy grail” for every trader? Or are there hidden risks that only experienced participants recognize? This article will dive into the pros and cons of both self-trading and prop trading, from real community insights, helping you make the best decision for your goals and circumstances.

2. Pros and Cons of Self-Trading vs. Prop Trading

2.1. Self-Trading: Freedom Comes with Heavy Pressure

Advantages:

- Full control over your capital: Complete autonomy without external rules or restrictions.

- Maximum strategy flexibility: Test and apply diverse trading styles freely.

- Time freedom: No deadlines, targets, or firm-imposed accountability.

Disadvantages:

- Extreme psychological stress: Over 70% of self-traders admit to account blowouts due to emotional trading with personal funds.

- Severe capital limitations: Even a 20% return on a $1,000 account yields only $200 — far below expectations.

- Lack of professional support: No access to AI tools, performance dashboards, or coaching programs like those provided by prop firms.

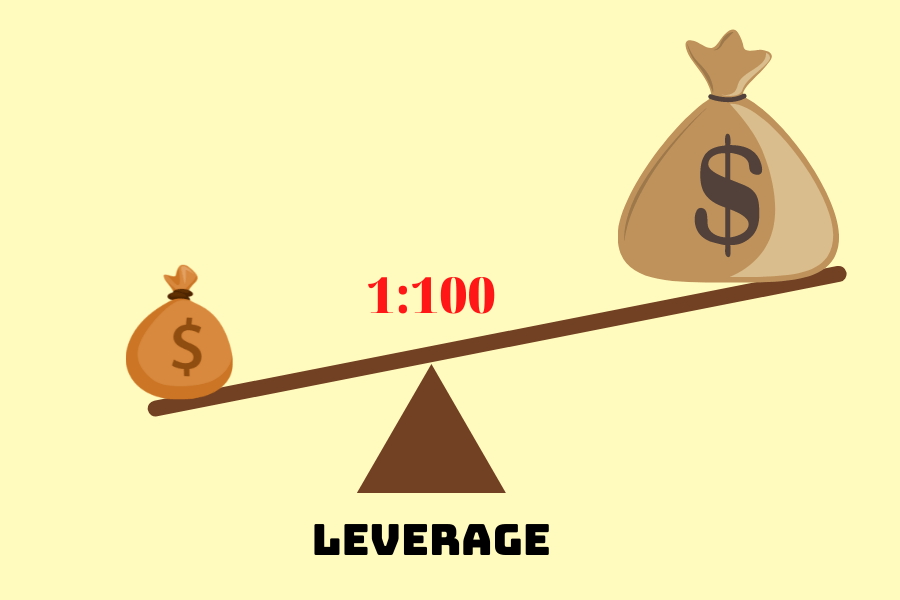

2.2. Prop Trading: Capital Leverage – Career Accelerator

Key Benefits:

- Access to large funding: Manage six-figure accounts after passing firm challenges — without risking personal capital.

- Transparent payout structure: Reputable firms ensure clear revenue sharing (e.g., 80-95%) with timely payments.

- Advanced tech ecosystem: AI analytics, coaching, and dashboards optimize trading and help improve skillsets.

- No fear of personal loss: Many traders feel mentally free and perform better without the risk of losing personal money.

2.3. Performance Comparison – When Should You Consider Prop Trading?

Over 60% of traders report better performance after switching from self-trading to prop trading. With more capital and powerful tools, success rates improve significantly. Experts recommend sticking to high-probability strategies, strict risk management, and avoiding impulsive trades to succeed in prop trading.

2.4. Real Success Stories 🌟

- Comeback journey: A Vietnamese trader failed with 3 personal accounts but succeeded with prop trading by applying discipline and leveraging coaching — now earning steady monthly payouts.

- Community + Tech: A group of young traders credit their growth to AI tools from prop firms, which enhanced their learning and helped overcome fear of losses.

2.5. Tips for Choosing a Prop Firm

- Prioritize reputable firms: Choose firms like AI Prop that offer clear payouts, strong tech, and vibrant support communities.

- Study the rules carefully: Understand drawdown limits, profit targets, and trading requirements to avoid disqualification.

- Build mental resilience: Prop trading is not a shortcut to quick riches — it’s a professional environment that demands discipline and strategy.

3. Prop Trading – The Modern Trader’s Evolution 💡

While self-trading builds resilience and market awareness, prop trading opens new doors — large capital, AI support, minimal risk, and a real shot at long-term trading careers. More and more traders are realizing the edge of prop trading and making the shift — not as a trend, but a practical and sustainable solution for ambitious traders.

Are you ready to step out of your comfort zone? Embrace prop trading — where opportunity meets innovation. Share your thoughts or stories below and let’s grow the AI Prop community together!